Longevity is a widespread goal in the hospitality industry, but how can hotel and resort owners develop sustainability in an unstable economy? The answer is essentially in the question: sustainability can be achieved by maintaining an ecological balance while using the available resources. However, investing in greener technologies is just the beginning, hoteliers need to be transparent about their green practices.

Why Green Transparency is Necessary

Green transparency will likely bring more guests to a hotel. In today’s world of online conferencing and staycations, the tourism market has taken a hit. If you want more people frequenting your hotel or resort, you will need to stand out as a socially conscious business. The first step is gaining that recognition among consumers. You can do so by defining your efforts to reduce your negative impact on the environment.

The Crowne Plaza in San Diego has implemented green practices for many years. Please inquire at Hotel Managers Group about their success stories.

Clearly stating your position and detailing your green practices means that travelers will know what to expect when visiting your property. Consumers can choose your services based on their needs and expectations. This may enhance their overall experiences at your property. Being upfront about your commitment to responsible tourism also engages consumers and instills trust, particularly if you are open about why green practices matter to you.

Another reason why your hotel should opt for transparency is that a larger consumer market can be reached. Many travelers are now looking for accommodations based on the green credentials of the business. Showing that you are committed to specific practices such as water efficiency, recycling and using clean renewable energy is a great way to pique the interest of your local community and beyond.

How to Market your Business as Green

The quickest path to green transparency is through a mission statement. Use this to declare your devotion to running an eco-conscious business. It is important to state your commitment to your consumers, their families and their budgets as well. Your green marketing campaign should also include an opportunity for travelers to provide feedback, whether it is via your website or consumer advisory resources.

Becoming certified by a reliable grading program, such as TripAdvisor GreenLeaders or the EPA, is another way to present your eco-friendly practices. This will allow you to provide a detailed listing of your efforts. Consumers can then offer praise or critiques regarding your green approach. With this type of grading system, you can cover issues such as energy, waste, water, business purchases, construction and employee responsibility.

Even if you are just beginning your sustainability journey, you can benefit from drawing attention to your environmental awareness. Something as simple as conscientious water management can boost your credibility with eco-conscious consumers. If you want to evaluate the water usage of your property and learn how to monitor and manage consumption, take a look at the following guides:

http://www.greenhotelier.org/know-how-guides/water-management-and-responsibility-in-hotels/

http://www.kuoni.com/docs/water_manual_hotels_thailand_0.pdf

Hoteliers who combine transparency with expertise and practicality exceed the expectations of the consumer. This typically results in more business. Applying that concept to a green mindset can only be advantageous. By sharing your mission with your target audience, you will not only raise awareness, you will increase trust. Illustrate your dedication to sustainable tourism, and you will ultimately show travelers that your principal focus is on them and the planet.

San Diego is an electric city that is continually evolving. From its modernized museums to its upscale restaurants, this coastal metropolis is always buzzing with activity. There will be plenty of new attractions to experience in 2015 for locals and tourists. Whether you want to plan a family day trip or you prefer to get a taste of the nightlife with friends, you won’t be disappointed by this vibrant city’s offerings.

Patriot Tour by Flagship Cruises

Start your San Diego adventures by taking a 30-minute high-speed cruise past the Coronado Bridge around the beautiful bay. The Patriot is a ship like no other with its dual turbo engines, each operating on 1,400 hp. Zip through the water as you listen to trendy tunes, feel the wind whip and watch the waves whoosh. After experiencing the most exhilarating 360-degree turns, you can take a break for some whale watching or enjoying the gorgeous seashore views.

AD Nightclub

This new hot spot is located in San Diego’s historic Gaslamp Quarter, and it’s redefining California nightlife. The intimate layout, cathedral-like stage, theatrical dancers, stunning visual displays and impressive sound system make visiting this club a truly immersive and unforgettable experience. The menu boasts a decent assortment of delectable small-bite snacks, a reasonably priced bottle service and delicious craft cocktails.

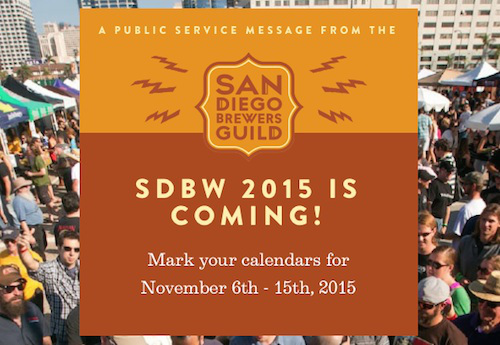

2015 San Diego Beer Week

To continue the party theme, don’t miss San Diego Beer Week in November. This 10-day festival celebrates the area’s breweries, pubs and restaurants in some unique ways. From pre-breakfast beer tasting to unusual tap takeovers, there is something for every fan of the foamy cold ones. You can enjoy even more frivolity throughout the year by heading to Old Town for the Tasty Adventures Beer Train Tour. Hop aboard the trolley for a tour-and-taste of four local breweries.

Early Morning with Pandas at the San Diego Zoo

For a more kid-friendly excursion, take a morning trip to the San Diego Zoo. You’ll be able to watch the giant pandas greeting the day, and you won’t have to squeeze your way through the afternoon crowds. You’ll also take a small-group tour around the zoo and see some other animals close up. If you cannot get enough of cute, furry creatures, make a day of your visit, and be sure to look for the newest animal babies at the zoo.

SeaWorld Shamu Habitat Expansion

This year, the killer whale haven at the San Diego theme park will undergo substantial changes. Plans include doubling the water volume of the current orca environment with newer, deeper tanks. The updated habitat will also provide 40-foot-tall underwater viewing windows. Completion on the project isn’t expected until 2018, but the buzz around the area is enough to generate excitement among kids and kids at heart.

Balboa Park 100th Anniversary Celebration

To mark the centennial of Balboa Park, the San Diego Natural History Museum is featuring three exciting new exhibits. The Discovery of King Tut runs currently through the end of April, and Maya: Hidden Worlds Revealed can be viewed from mid-June to January 2016. The third exhibition is Coast to Cactus in Southern California. This interactive display highlights the Southern California environment from the gorgeous coastline to the imposing desert landscape.

The Liberty Public Market

Have you ever wanted to catch a fish at Pike Place or sample the fare at the Ferry Building? You may get a chance to enjoy these experiences and live the foodie’s dream at the new Liberty Public Market in Liberty Station. This summer, the 22,000-square-foot indoor-outdoor food hall will open to the public. Make sure you wear your walking shoes so that you can take in every inch of this vast, culturally diverse venue.

If you want to discover more cool things to explore in San Diego this year, subscribe to our blog. You may be surprised at how many wonders this seaside area holds. For multi-day San Diego adventures, don’t forget to reserve your room with the Mission Valley Resort. Check out www.missionvalleyresort.com for details. We’ll be happy to assist in any way we can so that your visit is a memorable one.

She is 27, single, and sells real estate in San Diego. She is paying off a college loan, shares a house with two roommates and gets to the beach as often as possible. He is 31, living in New York and working for an investment firm on Wall Street. If you were born roughly between 1982 and 2000 (the millennial), you are classified as a millennial or member of Generation Y.

She is 27, single, and sells real estate in San Diego. She is paying off a college loan, shares a house with two roommates and gets to the beach as often as possible. He is 31, living in New York and working for an investment firm on Wall Street. If you were born roughly between 1982 and 2000 (the millennial), you are classified as a millennial or member of Generation Y.

The publishers of the Millennial Traveller report studied data collected from 7,600 young, international travelers between the age of 18-30. Millennials from more than 100 countries were surveyed and asked questions about their international travel preferences.

The Number of International Travelers who are Millennials

In 2014, more than 1 billion people, in all age groups, will have made a trip beyond the borders of their country. That is about one out of every seven people on the planet. Roughly 220 million, or about 20 percent of those international travelers, were part of the millennial generation. By the year 2020, the number of millennial travelers is expected to increase by 47 percent to 320 million.

What Type of International Travel Experience do Millennial Travelers Want?

It is dangerous to generalize or make any blanket statements about where the younger generation likes to travel, or what they like to do when they arrive at their destination. Some would prefer an all-inclusive resort in the Bahamas where they can lay on the beach and play golf. Others might want the solitude of a National Park. A significant number are looking for more authentic travel experiences.

They want to blend in to the local culture and learn about the native way of life. They want to go into a local restaurant, order the local cuisine, and engage the waiter or waitress in conversation. Many are willing to sacrifice some time at the touristy attractions so they can interact with the people in a more genuine way.

The Millennial Traveller Report

When the results of the survey were tabulated from respondents in 100 countries, the top-3 “preferred next trip destinations” were the United States (11 percent), Australia (11 percent) and the United Kingdom.

67 percent of the millennial travelers relied most often on travel information from family and friends when planning their international excursions.

80 percent felt that online travel reviews were very important in helping to make decisions such as what hotel to choose, the best attraction to see, or where to have a great meal. 56 percent said they would write reviews of their travel experience.

Millennial travelers are highly attached to their mobile phones. They don’t leave home without them. 43 percent of the respondents said they used their mobile phone about every 5 minutes.

On average, Millennial travelers spend about $125 more per trip than members of other generations. 50 percent said they spent 1,000 euros or roughly $1,250 dollars on an international vacation.

If trends continue as expected, the millennial traveler will be an even more important player in the global hotel and hospitality industry. Just about every hotel that wants to attract more guests in the future will have to focus on the millennial generation today.

Hotel Preferences are Largely Determined by Age

Hotel Preferences are Largely Determined by Age

No one would argue that the needs and wants of someone in their 50s or 60s are quite different than those of a person in their 20s or 30s. The baby boomer generation still listens to Elvis, Sinatra, and the Beatles. The millennial generation’s music preferences are more likely to lean toward Beyonce, Eminem and Pharell Williams. Someone in their 60s is more likely to be technologically challenged (how do you send a text?) while a 30 year-old could not live without a smartphone and uses social media sites regularly.

Travelers choose hotel rooms based upon location, price, level of service, and several other factors. Hotels cater to all market segments from budget to ultra-luxury. The travel and hospitality site Hotel Management recently published a 2014 report entitled Portrait of American Travelers. The study analyzed hotel and travel booking preferences of various generations. Below are the generally accepted parameters of each generation:

• Mature – individuals born before 1946 (Age 69+)

• Baby Boomer – Individuals born between 1946-1965 (Age 49-68)

• Gen X – Individuals born between 1966-1980 (Age 34-48)

• Gen Y / Millennials – Individuals born between 1981-2000 (Age 14-33)

Independent vs. Chain Affiliated Hotel or Resort

People across all age groups favor staying in a chain affiliated hotel or resort by a margin of 3:1 over an independent hotel. In looking for a reason that 75 percent of all travelers prefer chain hotels and resorts and only 25 percent would rather stay in an independently run hotel, there are several possible explanations. National chains come with a reputation, have bigger marketing budgets, and instill a level of comfort for the traveler.

Economy Hotels

This is the least popular category across the generations. Only 12 percent of the boomers and 13 percent of the mature generation say they preferred to stay at an economy hotel. Millennials (19 percent) and Xers (16 percent) also are not keen on staying in economy hotels. A reasonable explanation might be that most travelers see better value in paying a little more for the additional amenities of a mid-range hotel.

Moderately-Priced Hotels

A full 72 percent of matures and 69 percent of boomers prefer staying in this middle-of-the-road type of hotel. Generation X (61 percent) and millenials (60 percent) like moderately priced hotels, but not as much as the older generations.

Luxury Hotels

Age is a determining factor in the luxury market. Younger travelers exhibit a greater preference than older travelers. Generation X and millennials favor staying in luxury accommodations by 22 and 21 percent while mature travelers (15 percent) and boomers (19 percent) are less likely to book a room in a luxury hotel.

Getting the Lowest Rate

Senior travelers strongly favor using a hotel’s website like Marriott.com or Hilton.com as opposed to an OTA like Expedia.com or Priceline.com. The study shows that 58 percent of the mature segment like to deal directly with the hotel, while only 15 percent prefer to seek the lowest price through an OTA. Only 40 percent of millennials however prefer to book directly on the hotel’s website. Perhaps the older generation is more comfortable dealing directly with the hotel they plan on staying at rather than going through a third-party intermediary. On the other hand, the younger generation thinks that it is more convenient and costs less to use the services of an OTA. The fact is, with a simple phone call, most hotels will match any OTA price.

Motivation for Staying at a Specific Hotel

Members of the boomer and mature generations are influenced more by value for their money than are the millennial and Xer generations. Older travelers also cite past experiences with a hotel as being an important consideration when deciding whether or not to book a room. The younger travelers think that the location and room rate are the more influential factors in determining where to stay.

Features Liked Best on Hotel Websites

Generation X, Baby Boomers, and those born before 1946 all agree that the best feature when visiting a hotel’s website is the ability to easily check rates. On the other hand, the youngest generation found the visual aspects of a hotel’s website more appealing. Millennials go to hotel websites to see pictures of the property more than to check prices. A well-designed website with lots of pretty pictures that include environmental awareness, and interesting content is the best way to get the attention of millennials.

Whether you are talking about a hotel in the center of the city that caters to the business traveler, or a hotel near Disneyland that provides affordable accommodations for casual travelers, hoteliers should pay attention to the age of their clientele. It is impossible to make blanket statements about any age group, but in general, there are significant differences between the traveler under age 50 and the traveler over age 50.

Articles/Photos/Graphics Copyright ©2015 – All Rights Reserved

–

Marketing Strategies for Independent Hotels

Marketing Strategies for Independent Hotels

In order to be successful, independent hotels must have a solid marketing strategy in place. Imagine a scenario where a person needs a hotel room and there are at least a dozen hotels in the general area where they could stay. The individual could pick one at random and hope for the best, or they could do a little research online and find a hotel that fits their budget, offers the amenities they want, and has supportive reviews. Ask yourself: does my independent hotel have an online presence?

If that potential paying customer did not make a reservation, but sees several hotels along main street, which hotel are they most likely to stop at first? Chances are they are going to stop at a familiar brand like a Holiday Inn, Hilton, Marriott or Best Western. Choosing an unfamiliar independent hotel would probably not be their first choice, unless there is a particularly original theme that sets it apart. For starters, a hotel owner or sales manager can ask, does my independent hotel have curb appeal?

Major hotel chains spend millions of dollars each year to market their hotels. Competition for the paying guest is fierce and it is crucial for a hotel to develop its own identity. As the owner of an independent hotel, you may not have the resources to spend what the competition spends, but you still need to mount a campaign that separates you from the competition.

How to Create a Marketing Plan That Can Help Your Hotel: Four Easy Steps

1. Build Awareness – You can tell the world, or at least plenty of people, that you exist. As an independent hotel, you do not have the same name recognition as the bigger hotel chains. You can build brand awareness in many ways.

• Invest in signage that displays your hotel’s name so it can easily be seen from the road. The signs should be on your property as well as on roads leading to your hotel.

• Participate in community events and causes.

• Within your budget, advertise in print, on TV, or on radio.

• Take advantage of the power of the Internet. Social media is the most inexpensive and often most effective way of getting your name known.

2. Create an Image – Image is important because it helps define your hotel to the public. No hotel can be all things to all people. There is a reason why hotel accommodations range in categories from budget to luxury. Do you want to cater to family travelers, business travelers, or millennials? You can choose to be the trendiest hotel in town, or the best-value hotel, the most eco-friendly hotel, or the hotel that has the best free breakfast.

3. Develop Your Customer Base – It is always good news when a guest checks in to your hotel, but even better news when they like it so much that they come back again and again. By always providing great service with a big smile, you can develop a loyal customer base. Develop your customer base by building a mailing list. Then, use that mailing list to send thank-you notes to the people who stayed at your hotel. In the thank-you message, direct them to your website and ask them if they would like to receive your hotel’s newsletter. Entice them by offering a special rate on their next visit.

4. Use Powerful Advertising Messages – All hotels are expected to have clean rooms, comfortable beds, and ice machines on every floor. You want to set your hotel apart from the competition. The best way to do that is to emphasize what you do better than anyone else. Do you have an indoor swimming pool? Does your hotel have direct access to the beach? Does your hotel use non-toxic soaps and practice a user-friendly recycling program? Point it out, use your assets to your advantage!

Implementing Your Hotel’s New Marketing Plan

It is one thing to recognize that you need to have a better marketing plan than the one you currently have, it is an entirely different thing to know how to implement a better and more effective plan. Consider these suggestions for implementing a new plan:

1. Your Marketing Budget – It would be nice to have unlimited funds to create an outstanding marketing plan, but that is not always the reality for most independent hotel owners. Responsibly determine how much you can spend each year, or each month, and then decide how to allocate those funds.

2. Identify Your Target Market – Do some research and try to determine the audience that you are trying to reach. A scattered and disorganized approach is usually more expensive and less effective than focusing in on a group that is most likely to become a customer.

3. Choosing a Marketing Mix – You have limited funds, so you want to spend those in the most cost-effective way. You have many choices including newspapers, magazines, TV, radio, flyers, and direct mail. While those traditional methods still have some value, you get the biggest bang for the buck by creating a marketing mix that includes social media, videos and mobile marketing. You can reach more people for less money on Facebook or Twitter than with a slick brochure or a magazine ad. Remember also that by advertising online, you are saving trees by not printing on paper – point this out in your professionally designed online ad!

4. Stay within your Marketing Budget – It may be tempting to borrow money from some other sector of your hotel’s operations budget, but try not to. Never neglect pressing needs. Try simply to spend the money you originally budgeted for marketing more wisely.

5. Professional Help – Marketing is what brings customers through your hotel’s front door. Guests do not just show up by accident. If you or your staff does not have the required marketing skills, you are probably better off using your marketing budget to hire a professional marketing team.

A Few More Practical Tips

• Research and study the latest trends in hotel marketing. You do not want to model your marketing campaign on programs that worked 20 years ago, but are no longer relevant today. Doing business with a smile, however, is a constant that never goes out of style.

• Hold meetings with your staff and encourage them to share thoughts they may have about new ways to market your hotel. Make sure that everyone understands their role in carrying out whatever marketing plan you decide to use, for example being active in positive constructive ways on social networks.

• Check-out the competition to see how they are marketing their brand.

Your new marketing plan may not produce noticeable improvements in revenues in the very first month or two that it is implemented. Be sure to record your monthly revenues when your new plan begins. Then, keep records and measure your occupancy and daily room rates each month. If the plan is good, you should see a marked improvement in your numbers.

Articles/Photos/Graphics Copyright ©2015 – All Rights Reserved

–

Take a look at the U.S. hotel industry over the past few years and you will see that by almost every measure the industry is performing well. Occupancy rates are up. ADR is higher and RevPAR continues to climb. The hotel industry has benefited from the improving economy, but there is another reason why more people are traveling and staying in hotels. Hotel groups have been developing new brands that better meet the wants and needs of today’s travelers.

–

–

–

In recent years, many of the major hotel groups have felt a sense of urgency to introduce new brands to appeal to different segments of the market. Looking back over the last decade or so, Starwood Hotels and Resorts Worldwide, Inc. launched their Aloft lifestyle brand and eco-friendly Element hotel brand. IHG introduced its EVEN hotel brand for the active and health-conscious traveler. Global Hyatt Corporation launched Hyatt Place to meet the demands of today’s sophisticated traveler.

Since 2013, the number of new brands being introduced and developed has been on the rise. Discriminating travelers will have even more choices of places to stay. Hotel executives are anxious and excited to roll-out their new brands. If you are planning a vacation or a business trip, one of these new hotel brands may be the perfect fit.

AC Hotels

Already doing well in European cities like Barcelona, Milan, and Paris, Marriott is bringing the AC Hotel brand to the United States. The boutique-style hotel aims to target the millennial business traveler. In the parent company’s annual report, CEO Ann Sorenson describes the new AC brand as “a design-focused brand inspired by the fashion houses of Europe that appeals to younger business travelers.”

The very first AC Hotel in the United States just opened in New Orleans. The 8-floor, 220-room property occupies the former Cotton Exchange Building, and is just steps from the French Quarter and Bourbon Street. Plans are in place to build and develop 33 hotels in the United states over the next few years. The Miami Beach AC, at 2912 Collins Avenue, is set to open toward the end of 2014. Other locations that will be up and running in early 2015 include Kansas City, Asheville, Chicago, and JFK Airport.

All AC Hotels will take advantage of technology to improve guest experiences. Guests will be able to use a mobile check-in service to save time. The hotels have been designed with an RFID-enabled locking system that will eventually allow AC to offer keyless entry to the guest rooms. Of course there is free Wi-Fi throughout each property and USB charging ports to keep those mobile devices running.

In the food and beverage area, the trend among the younger business traveler is toward more snacking, bold and innovative flavors, and healthy eating. Each AC Hotel will have 24-hour snack-stocked lounges, and depending upon location, popular native dishes (Cuban coffee in Miami Beach, Gumbo in New Orleans etc.).

The AC hotel brand aims to build customer loyalty among the millennial traveler. Currently, millennials account for about a third of all business travelers. According to the Boston Consulting Group, by 2020, millenials will represent almost 50 percent of all business travelers.

1 Hotels & Resorts

Barry Sternlicht, the CEO of Starwood Capital Group, based in Greenwich, Connecticut, is the driving force behind a highly anticipated new lifestyle brand hotel that is designed to be one with nature. Sternlicht, who served as the Chairman and CEO of Starwood Hotels and Resorts for 10 years, divested his interests in the major hotel group to pursue other interests in the hospitality industry. As the head of Starwood Capital Group, his interest has turned to developing two new hotel brands: 1 Hotels & Resorts & Baccarat Hotels & Resorts. SH Group, an affiliate of the global real estate investment group Starwood Capital, will be managing the new brand.

A total of three, nature-inspired, 1 Hotels & Resorts are scheduled to launch in 2015. Both the South Beach, FL and Central Park, NY locations are expected to open in March of 2015. The Brooklyn Bridge Park location should open a few months later. Careful deliberation went into the selection of each 1 Hotel & Resort location. The brand will focus on sustainability, environment, local communities and doing all that is possible to become one with nature.

Each 1 Hotel will be unique and will feature open spaces bathed in natural light, organic and locally-sourced food, and rely on recycled wood and other materials. 1 Hotels & Resorts will incorporate socially responsible design and architecture with outstanding comfort and unparalleled service.

Baccarat Hotels & Resorts

Midtown Manhattan is the location for the first Baccarat Hotel & Resort that is set to open in early 2015. Starwood Capital Group is paying careful attention to every detail to make this ultra-luxury hotel and residence the most sought after address in New York City. Located on 53rd Street, just off of 5th Avenue, the 50-story building is a true standout.

The architecture of the Baccarat Hotel & Resort can best be described as the meeting between modern architecture and traditional, grandiose design. The facade of the building is all glass and, just like fine Baccarat Crystal, it sparkles. Luxurious and elegant are just two of the adjectives that can be used to describe the traditional French interior features and design. Whether you are walking in common areas or are relaxing in one of the 114 guest rooms (or 61 residences), you will be impressed by the soaring archways, French moldings, marble floors, and, of course the vast array of Baccarat Crystal.

Guests have quite a few options when selecting their accommodations. You can be quite content in a Classic King Suite, or you can opt for more space by selecting one of several different types of suites. For the tops in luxury, reserve the Baccarat Suite. All rooms and suites have floor-to-ceiling windows, sitting areas, premium bedding and other outstanding features one would expect in a luxury hotel.

Outstanding is the best way to describe The Restaurant. Executive Chef Shea Gallante prepares French cuisine that matches the finest restaurant in Paris. The Grand Salon is a great spot to relax and have a cocktail.

With a highly-trained and professional staff, every guest is treated like French Royalty. The concierge service aims to be the best in the city and does everything in their power to meet your needs and make sure that you have a memorable experience when you stay at the Baccarat Hotel & Resort.

–

Differentiating Your Hotel from the Crowd

In the ultra-competitive hotel industry, the hardest thing to do is to differentiate your hotel from the competition. With so many hotel chains and hotel groups competing for a finite number of paying customers, having a strong brand that appeals to a targeted audience, can make your hotel stand-out from all the rest. New brands can appeal to specific groups on a number of different levels including value, luxury, and lifestyle.

–

Canopy

Canopy by Hilton is a new hotel brand that is seeking to attract travelers by offering bold and unique design, expanded common areas that encourage social interaction, and the latest in technology. Hilton Worldwide CEO Christopher Nassetta described the thinking behind Canopy by saying “We saw an opportunity to not only enter the lifestyle space by developing a new brand, but also to redefine this category by creating a more accessible lifestyle brand.”

Hilton has already secured 10 U.S. locations (and one in London) for the new brand. Canopy by Hilton is headed to Miami, San Diego, Nashville, Oklahoma City, Indianapolis, Savannah, Portland, OR, Ithaca, Washington D.C., and Charlotte. The new hotels will either be built from the ground-up or through the conversion of existing buildings.

The promise of this new Hilton brand is to create unique experiences in a place that does not look like every other hotel you have visited. Lobbies will feel more welcoming and be conducive to social conversations. Healthy breakfasts will be served with such culinary delights like smoked salmon and quiche. Every hotel will be located in, and become part of, a vibrant neighborhood. You’ll be able to check-out a complimentary bike to explore the neighborhood and every guest will receive a welcome gift that reflects the best of the local region.

Hilton recognizes the importance of the millennial traveler but is not aiming the Canopy hotel solely at that demographic group. The hotel is open to anyone who does not like the feel of a chain hotel and would rather have a unique experience in a unique neighborhood.

Curio

Attaching the name Hilton to any independent hotel automatically gives that hotel more credibility and status. Hilton is joining forces with a number of established four and five star hotels to create a new brand called Curio. Many in the industry consider Hilton’s move to be in response to the recent introductions of Marriott’s Autograph Collection and Starwood’s Luxury Collection of hotels. The move allows Hilton to reach travelers who want a more individualized hotel experience but also want the assurance of quality, comfort, and consistency that is at the core of every Hilton brand. Partner hotels will continue to manage daily operations and retain an identity that is unique from other Hilton branded properties.

Letters of intent have been signed with the SLS Las Vegas Hotel & Casino in Las Vegas, NV; the Sam Houston Hotel in Houston, TX; Hotel Alex Johnson in Rapid City, SD; the Franklin Hotel in Chapel Hill, NC; and a soon to be named hotel in Portland, OR. The first Curio hotels in the U.S. will open in 2015.

Hotel RL

Red Lion Hotels Corporation is planning a new upscale hotel brand called Hotel RL. Incorporating the vibrant spirit of the Pacific Northwest while stressing community, environment, and unique experiences, Hotel RL is targeted for 80 locations in 80 U.S. urban markets. The design of the lobby features elevated seating areas (Called Steps and sort of like a sunken living room) where guests can congregate and socialize. The lobby area is designed like a coffee house (think Starbucks) and rooms will be designed to provide free Wi-Fi and other services that are in demand by millennial travelers. Rather than building cookie-cutter hotels that all look alike, existing property conversions will drive the new Hotel RL brand.

Developing Customer Loyalty – Building a base of loyal customers is certainly one of the most fundamental goals of any hotel operator. It costs a great deal of money to market and attract new customers. When you create a new hotel brand, you have the opportunity, from the start, to make a great first impression when guests “try out” the new place in town. If you do things right and please your guests, you will create brand loyalty. The benefit of creating brand loyalty lies in more future bookings at your hotel and other locations with the same brand.

Pendry

Montage Hotels & Resorts is launching a new lifestyle hotel in San Diego called Pendry Hotels. Currently, the hotel group has upscale properties under the Montage brand in Laguna Beach & Beverly Hills, CA; Deer Park, UT; Maui, HI; and Palmetto Bluff, SC.

Construction on the 317-room, 12-story Pendry Hotel in the Gaslamp Quarter of San Diego began in October of 2014 and the completed property is expected to open in 2016. It will include two restaurants, 22,000 square feet of meeting space, a spa, rooftop pool, beer hall, and a nightclub. The Pendry is aimed at young and hip guests and also hopes to attract locals to its nightclub, beer hall, and restaurants.

Quorvus Collection

In February of 2014, the Carlson Rezidor Hotel Group announced that they were creating two new brands – the Quorvus Collection and Radisson Red. Focusing on the Quorvus Collection, a brand of 5-star luxury hotels that will provide a distinct guest experience, the Carlson Rezidor Hotel Group plans to have 20 such properties by 2020. All Quorvus Collection hotels will be comprised of six core lifestyle elements – wellness, replenishment, style, inspiration, ambiance, and design – to deliver the type of experience its guests desire. The Quorvus Collection will include historic landmark properties, contemporary residences, classic boutique hotels and urban retreats.

Radisson Red

At the same time that Carlson Rezidor Hotel Group announced the new Quorvus Collection they also announced the launching of a second new brand called Radisson Red. Eadisson Red is self-described as a “Lifestyle Select” category hotel that is upscale, focuses on the smallest details and facilitates personal interaction, personal choice, and the advanced integration of technology into the hotel stay. Guests will be able to use a mobile application to check-in, order food from the deli, arrange for a taxi to the airport, and access many other services through the convenience of their smartphones. Radisson Red is expected to launch in major cities and urban centers of the United States in 2015.

–

Freedom to Innovate – A new brand gives a hotel chain the flexibility to inject some personality and do things somewhat differently than how they are done in their other branded hotels. A new brand can still maintain the parent company’s philosophy of providing outstanding service and great value, but it also has the freedom to reach those goals in its own way.

–

Tommie

Commune Hotels is introducing a new brand called Tommie that is scheduled to open in 2015. Taking its name from the company’s Thompson Hotels, Tommie is based on a simple and functional concept that appeals to travelers who are free-spirited and want comfortable accommodations without all of the frills. The rooms are described as “space- efficient crash pads” and the property includes public lounges called Reading Rooms and casual communal dining. Tommie hopes to attract the young, savvy, connected, and discerning traveler who values new experiences more than fancy hotel rooms when they travel. The first two Tommie Hotels are being developed on 31st Street in Midtown Manhattan and down in lower Manhattan in the West SoHo neighborhood.

Vib

Best Western is entering the Boutique hotel space in North America and the United States with its new Vib (pronounced Vibe). The hotel is being designed to be a vibrant and dynamic gathering place with different zones for relaxing and working. Guest rooms will be on the smallish size at approximately 200 square feet, but they will contain high-quality furnishings and fixtures such as an LED lit showerhead with mood lighting and a desktop that doubles as a headboard. The Vib revolves around its grand lobby which will include a bar, food service, and plenty of communal seating.

Virgin Hotels

Richard Branson is launching a new lodging concept with Virgin Hotels. Initial plans call for three hotels – one in Chicago (opening in December 2014), one in Nashville (opening in 2016), and one in New York (opening in 2017). By 2020, plans call for as many as 20 new Virgin Hotels.

According to the Virgin Hotel website, rooms will have free Wi-Fi with no bandwidth restrictions, reasonable prices on minibar items, a guestroom that can be divided by a sliding door, and an app that will allow guests to control the environment inside their room.

–

One Size Does Not Fit All

–

Sustainability is Key

IHG even rewards its properties, for example the Crowne Plaza Hanalei in San Diego managed by HMG Hotels was honored recently with the IHG Green Engage Environmental Sustainability Award. Tomorrow reaches us every new day, so taking the right steps today to remain in harmony with the local ecosystem and communities not only maximizes investment but is guaranteed to attract a steady stream of new visitors.

Are you looking for an inexpensive place to have a baby shower?

Surprise your favorite mom-to-be with a baby shower at one of San Diego’s most affordable — and fun — locations. Experience comfortable accommodations, friendly service, lovely surroundings and low rates when you book one of our well-appointed meeting rooms available in a variety of sizes. We’re conveniently located in Mission Valley Resort on Hotel Circle, making it easy to get everyone together for your event.

When it comes to details, we think of everything! Whether you invite 10 or 100 guests, trust our experienced, attentive staff to provide each and every one with an amazing experience. From planning unique themed events to ensuring that you never run out of snacks or beverages, we’ll make sure your baby shower goes off without a hitch.

We can satisfy any kind of food craving your guest of honor can conjure up, and there’s plenty of delicious food to satisfy the other guests as well. Larger groups can enjoy a variety of dining options, from our brunch buffet to dinner and drinks. We offer a mouthwatering selection of tasty menu items to suit every palate. Themed buffets make for a memorable experience, and our creative staff will be happy to coordinate all the details.

If the mother-to-be has an odd candy craving or you need something for a headache, our on-site convenience store is here to save the day. If you’re planning an early shower but decide to keep the fun going, our Valley Kitchen Restaurant and The Valley Tavern Sports Bar make great places to catch up over food and drinks. Audio-visual equipment is available for music and movies at reasonable rates.

You’ll enjoy a private setting with all the amenities you’d expect from a professionally operated San Diego hotel. Out-of-town guests will love the convenience of staying on-site, and you’ll appreciate having one easy locale to use as a home base for visiting guests and locals who want to spend an extra day or two reconnecting with old friends. Mission Valley Resort offers free parking, including spaces for the disabled, and our large facility is wheelchair-accessible throughout.

Create a fantastic experience filled with wonderful memories for the soon-to-be-mom and her friends and family. Contact Mission Valley Resort today to begin planning an affordable, fun-packed baby shower your guests won’t soon forget — for all the right reasons.